Russia’s vaunted military, especially its mechanised forces, lie battered and scattered while social media networks are filled with videos of charred carcasses and deadly attacks on Russian tanks

Source link

How to Build a Dynamic-Pricing Strategy That Works

HANNAH BATES: Welcome to HBR On Strategy, case studies and conversations with the world’s top business and management experts — hand-selected to help you unlock new ways of doing business.

More and more companies are turning to pricing algorithms to maximize profits. But many are unaware of a big downside.

Marco Bertini, a marketing professor at Esade Business School in Barcelona, says constant price shifts can actually hurt the perception of your brand and its products. He warns that employing AI and machine learning without considering human psychology can damage your relationship with customers.

In this episode, he outlines the steps you can take to avoid that – including some basic guardrails, overrides, and communication tactics. He also shares real-world examples of companies that use dynamic pricing to smooth demand and provide better customer experiences.

This episode originally aired on HBR IdeaCast in October 2021. Here it is.

CURT NICKISCH: Welcome to the HBR IdeaCast from Harvard Business Review. I’m Curt Nickisch.

When I was a teenager on a sports team, our team bus stopped at a McDonald’s restaurant. Waiting in line, we noticed that the board that showed the prices for the French fries and hamburgers had little wheels for the numbers. Whoever set the prices, spun the wheels to show the right number. One of us joked that they probably rolled the prices higher when they saw the bus pulling up.

And as you do, when you’re trying to be funnier than the next kid, we started imagining the prices bouncing around like stocks that if you were shopping at McDonald’s, you’d have to yell, “Buy now!”, when the price of a big Mac dropped to where you wanted to swoop in and pick one up.

What was totally laughable to us at the time is actually become the norm of pricing today. Algorithms that can change prices by the minute are commonplace. It’s not just airfares and hotel rates anymore. Check your ride sharing app a minute later, and you can get a wildly different number. Leave items in your online shopping cart, and the next day you’ll find a new price. Now there’s a clear incentive for this. Companies eke more profit out of every transaction, but what many of them fail to understand is how much this dynamic pricing is messing with the psychology and trust of their customers.

Joining us today to explain the harm that dynamic pricing causes and how to manage it is Marco Bertini. He’s a marketing professor at ESADE Business School in Barcelona and a visiting professor at Harvard Business School. With Oded Koenigsberg of London Business School, Bertini also wrote the HBR article, “The Pitfalls of Pricing Algorithms”. Marco, thanks for coming on the show.

MARCO BERTINI: Oh, it’s a great pleasure to be here.

CURT NICKISCH: Marco, I have to admit, preparing for this interview, I just hadn’t realized just how fundamental pricing has changed since you know, I was younger.

MARCO BERTINI: Well, it’s changed. It’s changed a lot. I think in great part by the way, companies start to understand and actually individuals as well, but the way companies start to understand the many of the ramifications that a price has when you transact your customers. Back in the days when you were at school, it was fundamentally an economics principle, right? A bar that you set higher and lower and more people come in and more people are left out, but there is just much more knowledge and awareness and conscientiousness of the psychology behind numbers, which makes it a lot more richer. On top of that is the issue that technology is allowing us to do many, many more things that we could do before and we’d price. It was just kind of fun.

CURT NICKISCH: Yeah. I mean, price has always changed, right? And people waited for sales or they used coupons, but it just felt much more stable and certain and simple, maybe is the way to put it. We’re used to kind of wait to try to gain the best airfare. Now you can almost do it for, for anything. It’s not just what you’re going to buy and whether the price is worth it, but, but when you are going to buy it or at what price?

MARCO BERTINI: Some would say even maybe too much, right? But I think it’s good to have a little bit of context to these, because again, if our recent history is one of fixed prices, essentially, where a product has its price and that’s it. And you see it on a price tag. And that’s literally it.

But if you wind the clock back a century or so, it was with bazaars and marketplaces, there was no such thing as a fixed price. There was haggling, right? There was bargaining and every interaction between a customer or a firm led to some sort of price, depending on how price conscious that particular customer was and how much the business wanted to sort of extract that profit. Then what happened? A scale happened in a sense that we wanted to start selling lots more stuff, to lots more people at scale.

And still we started building stores. And when you started building stores and especially department stores, it’s really hard to bargain and barter and haggle inside a department store. It just becomes very, very messy. So, to achieve that sort of scale, you start saying, oh, you know what, I’m going to put one price on this piece of item. So, the customer doesn’t need to interact with me, the salesperson, and everything will be great. There’ll be less friction in the transaction.

So, that’s kind of where we went. And that was stage two, let’s say, and then stage three is back to what I was alluding before. I can still with technology. I can still achieve that. This is where algorithms kind of come into it. I can still achieve that scale, that I so much desire, but I don’t necessarily have to stick to a price tag. And so, I can, I can actually have the benefits of both worlds. And so, in many senses, it’s kind of going back to the past, through the use of, of technology.

CURT NICKISCH: That’s amazing. I mean, there is a beauty, right, to the bazaar, price setting at a bazaar where, where the seller and the buyer haggle and basically the price is what the buyer and the seller agree it is at one moment in time. But if you take most consumers today, it seems a little exhausting or it makes, makes it feel much more adversarial somehow when you’re, when you’re trying to decide when to buy something.

MARCO BERTINI: Yeah, I would, I would definitely agree. And I think there’s a few things that are worth mentioning. One of them is it’s like a moving target a bit in the sense that social norms change all the time, right? If we wind the clock back aa sufficient amount of years, the thought of all of us paying different prices at a, at a concert, in an airplane, at a hotel was probably a foreign concept. And we would maybe take an objection to that.

But of course, that’s kind of sacred nature right now. We find that less intrusive, right? At the end of the day, commerce is a social phenomenon. I think, however, what you said is particularly true. There are situations where a company can take it too far. There are situations where it doesn’t have sort of the agency to do so, and the customer doesn’t really allow them implicitly to, to change prices so much or out of situations where customers actually look to the price for some sort of information. And when that information just keeps changing all the time, because the price keeps on changing, I’m left to fill in the blanks. And I would say, generally speaking, you do not want customers to fill in the blanks because often that leads down sort of a bad path.

CURT NICKISCH: Right, yeah. You get to that point where you think, oh, the company just noticed that I’m coming back to buy this and they railed the price.

MARCO BERTINI: Right. Exactly, exactly. But so often what I try to explain both to the students and to the companies, that I have the pleasure to work with is that when we think about these idea of customer focused, that it’s everybody knows about and everybody tries to strive for, if you’re a business, has two sides to it. It has like a front end and a back end to it.

So the front end of customer orientation is what we learn in marketing courses, which is: I’ve got a product or a service, and if I really want to do well in the marketplace, what I should be doing is understanding what the customer’s needs and wants and desires are, and then work my way backwards in terms of how to shape that product, how to communicate that product. So I’m being driven by the customer.

And so more and more, and again, especially with technology, organizations are thinking to themselves, well, how do I leverage technology to build that stronger relationship with customer and a stronger connection, which is great. In my opinion, there’s absolutely nothing wrong with that. The problem is that commerce is unique in the sense that at that moment, I then have to turn around and ask my customer for money. You know that saying, you know friends and money don’t mix everybody’s set up and everybody believes completely. In commerce, we don’t have the luxury of choosing one or the other. We kind of have to do both, right?

And so, on the one hand, on the front end, as I was saying before, you’re trying to build that trust with customers, which is again, it’s great, but then it’s becomes very delicate, right? Because I’m telling my customer who I had previously told him or her to trust me a lot to then say, okay, now I used to give me money.

So, it becomes a very, very difficult, very delicate thing to do. And if I start using algorithms to generate those prices, so prices are not only moving than they used to be, but also they’re moving in a way that may be disconnected. We had done the line psychology of that relationship. What can happen is that you’re driving a wedge between the front end of my customer orientation efforts and the back end, which is the more monetization element.

And whenever you drive that wedge going back to a comment I made before you start having the customer filling in the blanks, what’s going on? Why did they tell me these in the one hand, but then actually the pricing me that way? Are they standing behind what they’re saying? Are they truthful? Are they giving me what they promised?

CURT NICKISCH: Where does this go wrong sometimes? In your article, you gave the example of Uber at the time of a terrorist attack or the threat of a terrorist attack. Search pricing took the price of getting writers out of a certain area up five times what it normally is. There is some benefit of course, to offering, charging more money and drawing more drivers to help take people out of a certain area and at a high demand shock event like that, but what went wrong in that case, do you think?

MARCO BERTINI: So, I think if we, put yourself in the customer’s shoes. In the case of Uber, when these shocks happen, sometimes even if it is not, even if it’s not a harmful sort of situation, but more like a Christmas Eve or things, or New Year’s Eve, there is that sense, I think, from the customer perspective that it’s not as if I’ve got many options, right. I am, I’m at the mercy of the company. I am out here. I need to get out of here for whatever reason, and I literally do not have a choice.

CURT NICKISCH: So, what do you think Uber should do in a situation like that? Because it could still offer high reimbursement rates, right. To drivers to drive on New Year’s Eve, for instance, is that just one of those times when Uber should just lose money for the evening?

MARCO BERTINI: I mean that may be a solution, right? I don’t pretend to understand the fundamental economics of Uber, so I wouldn’t hesitate to sort of give them specific advice. But from where I sit, my objective would be to sit down with them. I mean, we make an example of Uber, but it could be this there’s millions of applications of algorithms. What I ideally like is for organizations to sit down and think beyond the standard economic argument of algorithms. That’s, because that, I think they’re in the best seat to judge what limits there are. If they’re made aware of those sort of side effects, or byproducts, I think they’re in the best seat to sit down and say, okay, oh, now that I know that these things could happen, and given what I know about the marketplace, where do I want to put those guardrails, for example. Or when should I expect something to potentially go wrong, and so to be weary of that? Or who should I put the decision in the hands of?

You see what I mean? It’s hard, right, to say I’m not Uber, so it’s hard for me to say, “Hey, oh, this is what he should have done.”. Yeah. Accept the loss for that day, because that’s the way you should go about it. I think I’m usually satisfied when you, in this specific case, anyway, when you get sort of an organization to think, okay, I didn’t know that when I set, when I vary my price, that releases information, beyond the fact by no buy now, buy later, wait, wait a second, by now. Beyond that sort of basic information, I wasn’t really aware that actually there is more information about that. And if we say internalize that idea, then, hey, all of a sudden you can have lots of different options. And importantly, some of those options may actually run against what you would do if you’re looking at it purely from an economic perspective, short term economics.

CURT NICKISCH: Let’s talk briefly about algorithms themselves, why they’re so powerful and so popular now, and is some of this evolution, just something that you see that can be built into algorithms going forward, that we just haven’t got there yet with how pricing is done?

MARCO BERTINI: Yeah. I really think that is the case. I mean, everything has its evolution, and the idea of using an algorithm to help me do a function that I was doing probably on a spreadsheet beforehand. It makes perfect sense back to what I was saying before. But again, the first intuition is I’m helping, I’m trying to get this algorithm to help me figure out where the brakes on the willingness to pay are, and sort of understand exactly what price fits better to what customer. That is the core, and it’s always going to be the core.

CURT NICKISCH: And that’s pretty powerful, right. I mean, that’s yeah.

MARCO BERTINI: Absolutely.

CURT NICKISCH: And just in today’s world with supply chains or maximizing the number of seats on a plane, it’s just, it’s crucial.

MARCO BERTINI: Absolutely. Right. Because either we have a fixed capacity that we would like to sort of make the most of or because, and I always tell this to my students, I want to move people around so that there’s a case just a second. There was a case of Disney in the article. And if I see myself with having seasonal demand, where very lots of people trying to come to my theme parks in the middle of summer or during the school vacations and less people going other times, I can use the algorithm, of course, to have a financial return by all means, but I’m actually using it to change the customer experience as well. Because if I can move people around and get families to come to realize there’s a trade-off between coming when you would really like to come, but maybe it’s the school vacation and another moment and accept that trade off.

Then what happens is that this is analogy so this appears a little bit, and everybody’s experience is actually much better because we didn’t have to wait so much in line. So, I guess my point I’m trying to drive is that, there is a core element to algorithms, which are just fundamental economics 101 just used with just done a bit better with, or sometimes even a lot better through technology, but then there’s this periphery of psychology and sociology that all mixes with that, that it’s typically a periphery, but in many, many cases actually can come to dominate. You got these Uber-like individual events that are, you know, so outrageous that just, you know, they just come to dominate. And they sometimes unfortunately shape the perceptions of the company, even though maybe only happened once or a few times.

CURT NICKISCH: So, what can be done to improve the machine learning that’s behind these algorithms to better incorporate, recognize human psychology? Is it, what is the answer here?

MARCO BERTINI: The answer, like many good answers tends to have multiple levels. The first thing is just, and I’m always very big on this, is just awareness of the problem, because if we don’t have awareness of that problem, that is like, there’s no reason, I’m just trying to push something down your throat that you don’t even understand why I’m pushing it down your throat.

So, the first thing is to understand, in my opinion in my experience, most organizations do not think of prices beyond the sort of the mechanics of it and the numbers of it. Right? So, there’s much more than a numbers thing. So, just like it’s more than a numbers thing when you’re setting prices yourself on an Excel and you change them every six months. It is also more than the mechanics when you’re changing it every second.

And guess what, it’s much more important when you’re changing it every second, because there’s a lot more stuff moving and lots of more inferences making. So, we have to understand that first. Once we understand that first, then I get second, you want to say, well, okay. So, there is inferences beyond the beyond, just when I should buy and how I should buy. Okay. Then what do I want to say? How do I make sure, from my perspective, I think it’s a two double, double-edged sword here or a two-way street maybe is the better analogy. The one way of the street is how do I use the algorithm to make sure that whatever my brand is, it resonates through the algorithm.

The other side of the street is understanding that the same thing happens the other way around. When I vary prices and my customers respond, that is like experiments. It’s a great experiment. Because people actually putting their money where their mouth are.

So, do I perceive, and this is a bit tricky. Do I use dynamic pricing of course, to get my products in the hands of customers, because that’s what I want primarily. But at the same time, I may actually proactively thinking about it as I, as an experiment where the variation in price is actually gives me a sense of what people are responding to in terms of their appreciation of a product.

Because if I bring something new to market and I really want to understand what they really care about, this one, a great way of learning about it is through some variation in prices, and then seeing how behaviors respond.

CURT NICKISCH: There can be a lot of benefits to dynamic pricing to the consumer. How should companies go about showing the benefits of that or making the decision making that they’re doing, in some cases on behalf of the consumer or to the consumer’s benefit, more apparent to the people they’re reaching.

MARCO BERTINI: Right. So, that’s a great question. And it kind of strikes at a sort of a bigger, I would call it problem. Whenever a company tries to move away from one price to all of its customers, to a series of prices, to its customers. And it does that because it realizes that people just have different valuations for the things that you sell. Some people like it more, some people like it less, that’s just nature. So, whenever we start thinking about those kinds of things, I think many of us, maybe most of us, jump up and say, oh, see, that’s just very nasty, right? The company’s trying to exploit. And the fact that I have a high willingness to pay and just, it’s just not nice.

I mean, I’m biased because I’m a pricing person, but I think it gets a bit of a bad rep, right. Because what happens is that I’m basically de-averaging something. So, I’m the de-averaging the price. And yes, it’s true that some people, if I am able to, will end up paying more for something that we’re paying less for beforehand, but hold on a second, there’s actually people that are paying, are now asked to pay less for the same product or service. And maybe in beforehand, they were not able to afford accessing the part of the service, but now they do.

Think of categories where access becomes, it’s of basic importance. Maybe healthcare, maybe education, maybe insurance. I can just sort of line up a few of these, right? So, in situations where you really want to get all the market covered, because they really should have coverage. Pretty much, the only way you can do is either A, I bring the price, the one price down to zero, in which case you’ve got this dilemma that I’m actually not making any money, and therefore, as a company I might not be alive very long.

Or I flex my prices as much as I can such that there is some sort of cross subsidization going on in the marketplace. And you had the ones that are willing to pay more able to pay more. So, cox subsidize the ones that are willing or able to pay less. So, I guess what I’m getting at is that one huge advantage of flexing your prices, which can then be done dynamically through algorithms, is that it just broadened access so much more, and in some categories, that is really what you’re after.

CURT NICKISCH: Yeah. That’s interesting. And then you have to communicate that somehow.

MARCO BERTINI: Exactly. So that’s the bad rep part is that maybe what you haven’t done very well is explain it. And I’m thinking of an example here as just as I’m talking, I know these at least one business in the providing food. So I’d say as a chain of restaurants providing healthy food, and part of its mission is to make sure that even households with a lower income who may otherwise go to a fast food place and the fast food perhaps is not the best type of food to eat on a regular basis, even lower income households have access to more nutritional meals. And so they’re very open about the fact that what they’ll do is they will charge for the very same bowl, for the very same salad, for the very same main course, whatever it may be. For the very same plate, they will charge a very different price within different areas of the city, in which there might be in, trying to judge, depending on the area, the zip codes, what the purchasing power may be of that particular neighborhood, right. And so, they’re very upfront about the fact that we’re going to charge different prices because our goal is to have nutritional food available to all. And that is kind of a higher goal then there might be sort of just keeping those prices constant and maintain a certain profitability.

CURT NICKISCH: When you’re talking about this high level now, I understand those, I understand that perspective kind of as a leader in an organization how you’re trying to think about that. What are some practical things that you can do then to follow through on this?

MARCO BERTINI: Yeah, absolutely. So, that was like the step two. I think we mentioned before, I says they step three and beyond there are the more we’re slowly landing this other, the step three and more and more of the practical, the practical aspects. So, and some of those things came out in our discussion already. So, the idea of guardrails, I think it’s kind of established now and it’s an important thing to sort of stress.

But some understanding of where the variation may arrive to a point that is just it’s extreme, and, therefore, the customer will start saying, what is going on here? Remember, one of the things that I was stressing is that you don’t necessarily want your customers to fill in the blanks. So, if A, if you’ve got a narrative that you can explain why these variations are there, then by all means, but if there is no such thing as a narrative, then you want to make sure that you sort of you’ll hold yourself to certain patterns.

Related to that one is the notion that you really want your algorithm to be connected in a much stronger way than it probably is right now to the strategic decisions of the organization. And maybe even better said, the marketing of positioning value proposition ideas of the organization. And what do I mean by that?

So, generally speaking – and maybe again, maybe we’re generalizing a bit too much – but I think it’s fair. Generally what you tend to have is that these algorithms are, it’s just a software that I’ve heard from some people that I should be applying in my business. So, I do some research, of course, and then I bring it in and most likely have a data team that is managing it and helping me with that, maybe some of the pricing folks as well. And that’s great, nothing wrong, absolutely wrong with that. But that sort of structure is the one that will maximize the economic aspect of these algorithms. The more psychological slash sociological aspects that relate to inferences about the company and the products, those are not typically the expertise doesn’t lie in those particular functions of the business.

CURT NICKISCH: You know, this has been really helpful, Marco. Can you give one example, just shining example of a company that you saw do, something that you thought was really smart when it came to trying to solve this problem?

MARCO BERTINI: I always liked the way Disney at least overtly was approaching the topic, because it thinks about the topic in an even more strategic way. Of course, there is the element of like, we’ve been saying across this interview that the more I’m able to flex my prices properly, given the right kind of variables, then I can sort of really customize that price. And that is great. But then there is the customer experience angle, which we had mentioned whereby what’s actually happening is that if I provide folks with a menu of different prices that are moving dynamically, then people will make a decision when to attend.

And what I can do is I can smooth out demand, hopefully. And then what is interesting to me, maybe as I came more as an academic is I am using my prices to change the experience of the customer. That is, I’m using my prices to change the value they derive from the product itself, which is weird because it should be that way around. You have a volume, then you capture through your price, but actually the way I price actually changes the value itself in a sense. And then on top of that, there’s also a third element. So, there is experience element, there is the sort of revenue element, and then there is a cost element, right? Because if I change, again, the behavior of customers, if I’m successful at that, through my use of my algorithm, I’m also lowering my cost base.

And so I kind of have this sort of triple whammy effect and, it kind of strikes at the heart of most of the things we try to do in business in general but in particular when it comes to pricing, which is whatever dollar I invest in something think about discount or whatever dollar of discount that I invest, I want to get the biggest return possible. And so, the more things I can get out of that $1 of investment, and in this case, the more I can get out of the algorithm doing its thing, the better it is. And they’re pretty smart about it in my opinion.

CURT NICKISCH: Marco, this has been fantastic. Thanks for sharing these insights with us.

MARCO BERTINI: Thank you very much for listening to me.

HANNAH BATES: That was Marco Bertini – in conversation with Curt Nickisch on HBR IdeaCast. Bertini is a marketing professor at Esade Business School in Barcelona.

We’ll be back next Wednesday with another hand-picked conversation about business strategy from Harvard Business Review. If you found this episode helpful, share it with your friends and colleagues, and follow our show on Apple Podcasts, Spotify, or wherever you get your podcasts. While you’re there, be sure to leave us a review.

And when you’re ready for more podcasts, articles, case studies, books, and videos with the world’s top business and management experts, find it all at HBR.org.

This episode was produced by Mary Dooe, Anne Saini, and me, Hannah Bates. Ian Fox is our editor. And special thanks to Maureen Hoch, Nicole Smith, Erica Truxler, Ramsey Khabbaz, Anne Bartholomew, and you – our listener.

See you next week.

Source link

Markets to take cues from global trends, FII trading activity: Analysts | News on Markets

)

Last week, the BSE benchmark jumped 730.93 points or 0.91 per cent, the Nifty climbed 173.65 points or 0.71 per cent | Image: Bloomberg

With the earnings season drawing to a close, stock markets will take cues from global trends and foreign investors’ trading activity this week, analysts said.

The US FOMC (Federal Open Market Committee) minutes will be the major highlight this week, experts said.

“This week, there are fewer cues on the macro and micro fronts, as the Q1 earnings season has concluded. However, important global economic data, such as Japan’s inflation numbers and the minutes from the US FOMC meeting, will be closely watched. The uncertain geopolitical situation remains the primary near-term risk for the market,” said Santosh Meena, Head of Research, Swastika Investmart Ltd.

Traders will also closely monitor institutional flows and crude oil price movement, he added.

Easing fears of a recession in the US triggered a global market rally on Friday.

“Positive US economic data like cooling inflation and robust retail sales numbers shrugged off recession fears while talks of a rate cut by the US Fed as early as next month fuelled a mega rally across global equities, including India,” Prashanth Tapse, Senior VP (Research), Mehta Equities Ltd, said.

The 30-share BSE benchmark jumped 1,330.96 points or 1.68 per cent to settle at 80,436.84 on Friday, marking its best single-day gain in more than two months. The NSE Nifty surged 397.40 points or 1.65 per cent to close at a two-week high of 24,541.15.

“The outlook for the market will be guided by the FOMC meeting minutes, US existing home sales and new home sales data,” Palka Arora Chopra, Director, Master Capital Services Ltd, said.

Last week, the BSE benchmark jumped 730.93 points or 0.91 per cent, the Nifty climbed 173.65 points or 0.71 per cent.

Siddhartha Khemka, Head – Retail Research, Motilal Oswal Financial Services Ltd, said, all eyes this week will be on US Fed meeting minutes.

“Overall we expect the market to consolidate in a broader range and take cues from global factors,” Khemka added.

(Only the headline and picture of this report may have been reworked by the Business Standard staff; the rest of the content is auto-generated from a syndicated feed.)

First Published: Aug 18 2024 | 10:17 AM IST

Source link

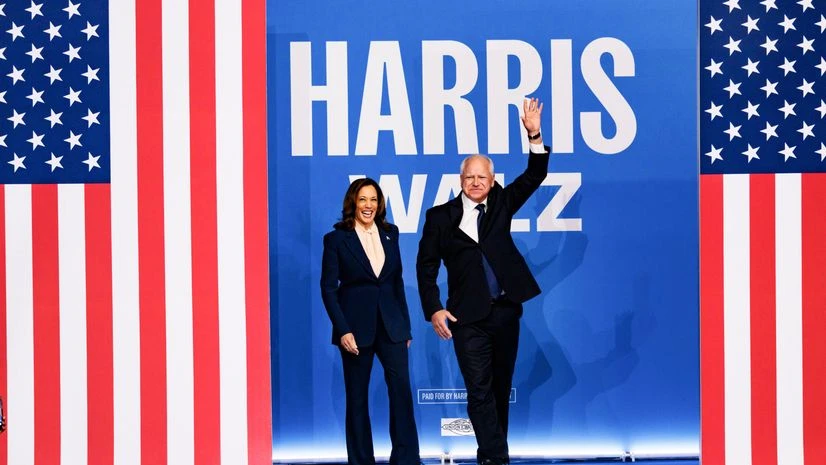

Harris-Walz campaign to spend $370 mn on digital, TV ads in push to Nov. 5 | World News

)

Harris-Walz campaign says it plans to spend at least $370 million on digital and television ads. Image: Bloomberg

The Harris-Walz campaign says it plans to spend at least $370 million on digital and television ads between Labor Day and Nov. 5, the final stretch of a race to reach voters mostly in battleground states.

The campaign this weekend placed $170 million in TV reservations, which comes on top of $200 million in digital reservations, deputy campaign managers Quentin Fulks and Rob Flaherty said in a memo Saturday.

The reservations include time during major sporting events and “high-viewership moments” like the season premieres of Grey’s Anatomy and the Golden Bachelorette and are intended to introduce Harris to voters and not let Trump define her, the campaign said.

For August, Trump and his allied super-PACs have booked about 60 per cent of the ad time, reversing the advertising advantage Democrats have had for most of the campaign.

Trump-aligned Preserve America PAC launched its first round of advertising during the Olympics last month and plans to spend about $60 million through Labor Day, according to a person familiar with its plans.

Harris, Trump Duel Over the Airwaves With $247 Million Ad War

Both campaigns have injected millions of dollars worth of television ads since Harris entered the race, a sign that both teams are flush with cash and hoping to leverage that into a polling edge.

As of Aug. 14, the presidential campaigns and their allies have already bought or reserved $247 million in ad spending to run this month, 19 per cent more than they did in all of August of 2020, according to data from ad-tracking firm AdImpact compiled by Bloomberg.

Largely funded by Las Vegas Sands Corp. majority shareholder Miriam Adelson, the super-PAC expects to spend more than the $100 million it spent in 2020, the person said. It has focused most of its advertising on the border crisis.

The Harris-Walz campaign also placed more than $200 million in digital reservations on platforms like Hulu, Roku, Youtube, Spotify and Pandora. The reservations include day-time programming on Fox News, which reaches “a more moderate audience,” they added.

“Our data is clear that the hundreds of thousands of Nikki Haley voters in the battlegrounds and other conservative leaning independents are moving towards us and we’ll be meeting them where they are.”

First Published: Aug 18 2024 | 7:27 AM IST

Source link

Research: How IT Can Solve Common Problems in DEI Initiatives

Lessons from three organizations that successfully leveraged IT to drive structural change.

Source link

Urgent need to address $4 trn financing gap to accelerate SDG progress: FM | Finance News

)

Fresh capital infusion should remain an active option for consideration of MDB boards, along with balance sheet optimization measures and financial innovations, she said. (Photo: PTI)

Finance Minister Nirmala Sitharaman on Saturday said that inadequate access to developmental finance is hindering developing economies from achieving Sustainable Development Goals (SDGs) and underscored the urgent need to address this USD 4 trillion annual financing gap.

Addressing the third Voice of Global South Summit virtually, Sitharaman said that recent reports reveal that the implementation of many SDGs in developing economies is stagnating, with some indicators even regressing.

The SDG financing gap is estimated to be USD 4 trillion annually for developing countries, she said.

Observing that the global South is affected by global uncertainties, she said one in four developing countries will be poorer by the end of this year than they were before the pandemic as per a recent World Bank report.

“Growth thus remains insufficient to drive progress in development and poverty reduction. To accelerate progress on SDGs, there is an urgent need to address the USD 4 trillion financing gap.

“During India’s presidency, the G20 recommended wider adoption of social impact instruments and other blended finance instruments, monitoring and measurement frameworks and risk mitigation measures,” she said.

“Our efforts also led to the G20 Sustainable Finance Technical Assistance Action Plan, which is now being implemented under the Brazilian presidency to build capacity for scaling up sustainable finance tailored to the needs of Global South,” she said.

Stressing that growth remains the best antidote to many economic and social challenges, she said it creates a positive feedback loop where improved economic performance leads to greater financial opportunities.

“Our priority should be a people-centric growth path that empowers the most vulnerable and marginalised to participate in the development journey,” she said.

Talking about reforms at multilateral development banks, Sitharaman said these institutions need to be comprehensively revamped so that they can mobilize the much-needed additional financial flows to help developing countries meet their development needs and address global challenges.

Besides, she said, “It is critical that the financing requests made to MDBs are met with speed and agility. This will require reforms, both at operational levels as well as identifying new additional sources of finance.”

On concessional finance, she said, while low-income countries will remain the priority, it is important that the dedicated concessional windows are made available for middle-income countries to address climate-related challenges.

With regard to private capital mobilization, she said, MDBs need to engage with credit rating agencies and explore how to better incentivize the flow of private capital for development financing.

(Only the headline and picture of this report may have been reworked by the Business Standard staff; the rest of the content is auto-generated from a syndicated feed.)

First Published: Aug 17 2024 | 8:07 PM IST

Source link

Yunus calls redesigning financial system & pushes for social business at Voice of Global South Summit | External Affairs Defence Security News

)

Our education system and financial system are built only for creating job seekers and providing jobs for them. We have to redesign our system, he said (Photo: PTI)

Muhammad Yunus, Chief Advisor of the Bangladesh government, on Saturday called for redesigning the financial system in the Global South to ensure wealth is shared by all and asserted that combining entrepreneurship with social business can create miracles.

If we give an important place for social businesses, that is businesses which are created solely for fixing social and environmental problems, the 84-year-old Nobel laureate said, adding, that it can set a path to create a world of three zeros zero net carbon emissions, zero wealth concentration, and zero unemployment.

Yunus was addressing the Third Voice of Global South Summit’ being hosted virtually by India.

Pointing out that today’s youth want jobs, just because they are prepared by an education system in all our countries to get ready for jobs with their creative capacities forgotten, Yunush, the pioneer in microfinancing in Bangladesh, called for redesigning the system.

Our education system and financial system are built only for creating job seekers and providing jobs for them. We have to redesign our system, he said and hoped that it could be done together by the Global South, which is rich with a fantastically creative young population.

Combining entrepreneurship with social business can create miracles, said Yunus, who assumed office as the Chief Adviser of the interim government on August 8 amid the social and economic crisis in the country after Prime Minister Sheikh Hasina resigned and fled to India on August 5.

We would like to propose some common facilities in the Global South to take concrete steps to unleash the creativity and energy of our young population through social business, the former professor known for his award-winning work in micro-finance said.

My life-long experience has been that our financial system is created to promote wealth concentration. We have to redesign our financial system to make sure wealth is shared by all.” Yunus, who won a Magsaysay Award for Community Leadership in 1984 for his pioneering efforts in enabling rural men and women to become economically self-sufficient, said.

It should not be a one-way path for wealth. We must ensure financial services for all people, particularly women and youth. We can learn from each other how this can be done successfully, he added.

Finance should never be a wall for anybody. It should be designed to unleash entrepreneurship and creativity. Social business banks can be encouraged to be created for solving problems such as poverty and unemployment, he said.

Yunus also invited the leaders of the Global South to work together to create social businesses to address all environmental and social problems and said, It can become a massive force if we work together.

(Only the headline and picture of this report may have been reworked by the Business Standard staff; the rest of the content is auto-generated from a syndicated feed.)

First Published: Aug 17 2024 | 5:36 PM IST

Source link

When a New Hire Feels Like They Weren’t Your First Choice

HBR Learning

Diversity, Inclusion, and Belonging Course

Accelerate your career with Harvard ManageMentor®. HBR Learning’s online leadership training helps you hone your skills with courses like Diversity, Inclusion, and Belonging. Earn badges to share on LinkedIn and your resume. Access more than 40 courses trusted by Fortune 500 companies.

How to build a better, more just workplace.

Source link

Foreign exchange rules amended: Cross-border share swaps eased by govt | Economy & Policy News

The Union Finance Ministry on Friday announced key amendments to foreign exchange (forex) regulations, including mandating government approvals for all investments originating from countries that share land borders with India.

The latest amendments also seek to simplify cross-border share swaps and streamline key definitions, such as “control”.

The updated regulations have aligned the treatment of downstream investments made by overseas citizen of India (OCI)-owned entities with those owned by non-resident Indians (NRIs) on a non-repatriation basis. This is expected to foster greater participation of NRI funds in the Indian market.

“This (amendments) will facilitate the global expansion of Indian companies through mergers, acquisitions, and other strategic initiatives, enabling them to reach new markets and grow their presence worldwide,” a Finance Ministry statement said on Friday, while announcing amendments to the Foreign Exchange Management Act (FEMA).

Of particular significance is the clarification on government approvals for investments. Previously, such approvals were required only when the Indian company operated in a sector where foreign investment was subject to government review. However, under the new amendments, government clearance will now be necessary for any transfer of shares involving countries that share land borders with India, regardless of the sector in question, explained Mayank Arora, director of regulatory affairs at Nangia Andersen India.

The amended rules have also brought clarity to the position of OCIs. “In a welcome move that will benefit OCIs, the relaxation available to NRIs — where investments made on a non-repatriation basis are not considered as FDI — has now been extended to OCIs,” said Rajesh Gandhi, a partner at Deloitte.

In another key change, the definition of “control” has been standardised to ensure consistency across various Acts and laws. The rules now specify that two or more foreign portfolio investors (FPIs), including foreign governments, will be considered part of an investor group if they share more than 50 per cent common control.

“These amendments underscore the government’s commitment to creating a foreign-investor-friendly climate, with continued efforts to simplify rules and promote ease of doing business,” said the Finance Ministry.

The move follows the July 23 Budget announcement which stated: “The rules and regulations for Foreign Direct Investment and Overseas Investments will be simplified to facilitate foreign direct investments, nudge prioritization, and promote opportunities for using Indian Rupee as a currency for overseas investments.”

The Foreign Exchange Management Act (FEMA) now also has a revised definition of a “startup” to align with the latest notification from the Department for Promotion of Industry and Internal Trade (DPIIT). Under the latest DPIIT notification, turnover threshold for being a startup has been increased from Rs 25 crore to Rs 100 crore. Further, startups would continue to be recognised as such for a period up to 10 years from incorporation.

“This alignment of the startup definition with the DPIIT’s broader framework provides clarity on the status of startups for FDI purposes and will make such startups more attractive to foreign investors,” said Arora.

Additionally, a specific provision dealing with the swap of equity shares has been introduced. This allows for share swaps even in cases where government approval is required, whether due to the sector or the geographical origin of the foreign investor. Such swaps will be permitted only after government approval has been obtained. The definition of equity capital has also been updated to align with the latest Foreign Exchange Management (Overseas Investment) Rules, 2022.

First Published: Aug 16 2024 | 10:41 PM IST

Source link

National Awards: Malayalam movie ‘Aattam: The Play’ is best feature film | Entertainment News

Malayalam film “Aattam: The Play” won the award for best feature film and Sooraj R Barjatya was judged best director for the Hindi movie “Uunchai” in the National Film Awards announced on Friday.

The best actress award was shared by Nithya Menon, who got it for the Tamil film ‘Thiruchitrambalam’, and Manasi Parekh for the Gujarati movie “Kutch Express”. The award for best actor went to Rishabh Shetty for the Kannada hit “Kantara”.

Neena Gupta was best supporting actress for ‘Uunchai’ and Pawan Malhotra best supporting actor for the Haryanvi film “Fouja”.

Sharmila Tagore and Manoj Bajpayee starrer “Gulmohar” won the award for Hindi film. Bajpayee also got a special mention.

A R Rahman won the National Film Award for best music director (background music) for his work in Mani Ratnam’s “Ponnyin Selvan-Part 1”, which was also named the best Tamil film. Pritam got the award for best music director (songs) for “Brahmastra-Part 1”.

The awards were announced by feature film jury head Rahul Rawail.

(Only the headline and picture of this report may have been reworked by the Business Standard staff; the rest of the content is auto-generated from a syndicated feed.)

First Published: Aug 17 2024 | 12:00 AM IST

Source link

What Leaders Can Learn from Training Like an Olympic Archer

The discipline of archery, with training that emphasizes purposeful practice, mindful focus, mental toughness, and adaptability, offers useful lessons for business leaders. Just as archers break the skill of using a bow and arrow to hit a target from distance into component parts, such as stance or aim, executives can break the task of “becoming a better leader” into specific, actionable, and manageable steps. Just as archers are taught to concentrate intensely and channel all their energy into the perfect shot through rigorous mental training, including meditation and self-talk, businesspeople can use similar techniques to develop transformative focus. Just as archers practice visualization and cognitive reframing to manage stress and maintain composure in challenging situations, leaders can also use scenario planning and self-talk to become more resilient. Finally, just as archers to develop their ability to adapt to varying conditions—wind, light, and even their physical and mental state on a given moment or day—executives can try similar exercises to better prepare for the unexpected.

Source link

Mining corporation revamps decision-making to fast-track projects | News

The National Mineral Development Corporation (NMDC) has empowered its directors and project heads with controls by revamping the Chairman-Cum-Managing Director (CMD)’s delegation of powers.

The move is in line with the state-run miner’s target of reaching 100 million tonnes (MT) capacity under ‘Vision NMDC 2.0’, said Sanjeev Sahi, who heads Bailadila Iron Ore Mine (BIOM)– one of NMDC’s two mechanised mines in Dantewada.

The powers delegated to the CMD would now flow down following a pyramid structure of hierarchy. This would aid quick decision making, reduce time for executing projects, enhance production and achieve capex targets at a better pace, he added.

“Consequently, the heads of departments at head office and for projects (around 12 -13 for each project) have been empowered with tendering powers (which were not there in the earlier delegation of powers). This has resulted in decentralisation and expeditious processing of cases at the respective levels in cases of schemes sanctioned by higher authorities,” Sahi said.

The powers delegated by the board to the CMD in 2008 and to the Empowered Committee of Directors (ECoD) in 2014 can only be amended by the Board. This remains unaltered.

However, the CMD can only sub-delegate powers to subordinates and that too within his/her own delegated powers, Sahi said, adding, a new concept of ‘Works Vertical’ will focus on construction activities at major projects.

Senior-most officers, who have been delegated the powers equivalent to the Heads of Projects, head these verticals.

First Published: Aug 16 2024 | 4:10 PM IST

Source link